We provide rich, compelling and objective research into the effects of land value taxation for policy makers and citizens alike.

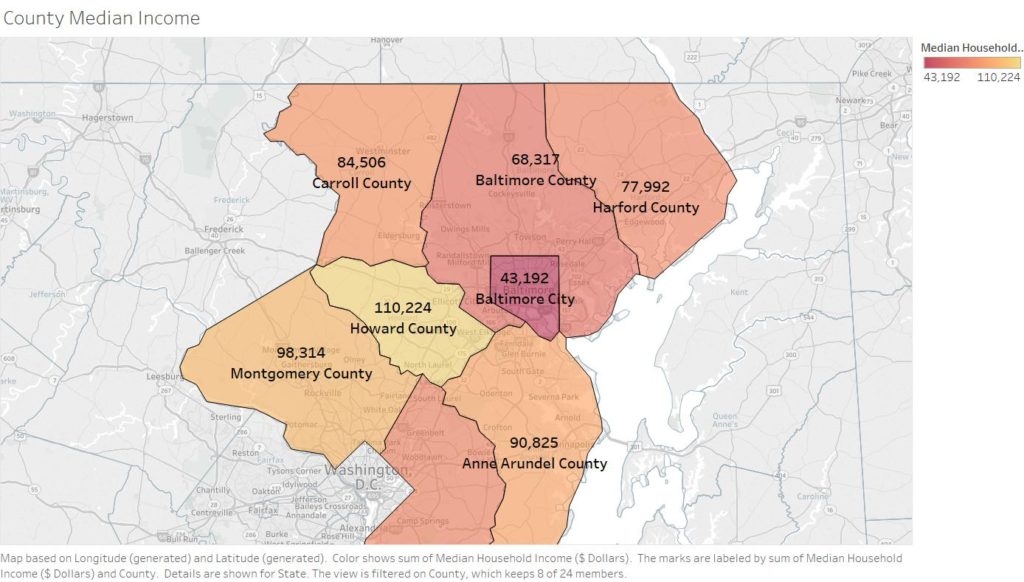

How can The City of Baltmore hope to succeed when wages lag far behind the Region. This is part of our research and work.

Hartford loses every year when so much land is tax-exempt, and much of the rest serves as “Cheap parking.”

Other forms of tax distort markets and shortchange citizens with regressive taxes.

In true rich/poor states, traditional property taxes also grab the incomes of citizens, due to the relainece on tax buildings rather than land values.

The burden of tax can literally lead to the destruction of the urban fabric…

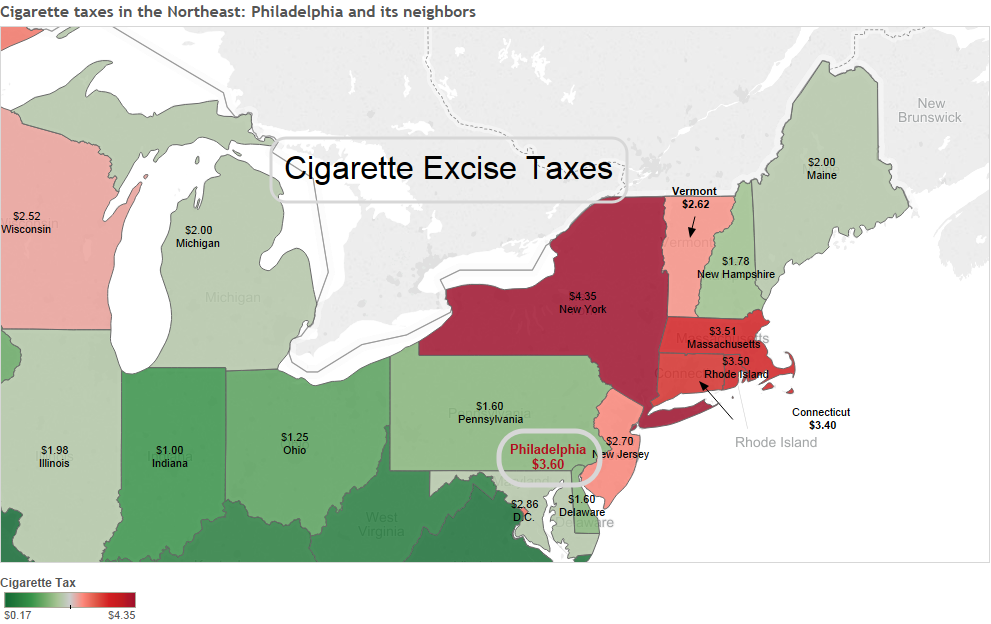

New Jersey and Pennsylvania are both nice places, but where is it easier to live, work, and basically enjoy life?

The cost of holding land in the heart of Pittsburgh is presently a pittance; the tax structure rewards underuse and blight.

A good use of land with “best use” buildings is now punished by the tax system. LVT will correct that.

Landowners get rich while sleeping, but builders and consumers struggle to get access to new highly valued sites.